mississippi state income tax form

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. 0621 Mississippi Income Withholding Tax Schedule 2021 801072181000 Reset Form Print Form.

You must file online or through the mail yearly by April 17.

. Details on how to only. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

We last updated Mississippi Form 80-105 in January 2022 from the Mississippi Department of Revenue. If you are receiving a refund. This form is for income earned in tax year.

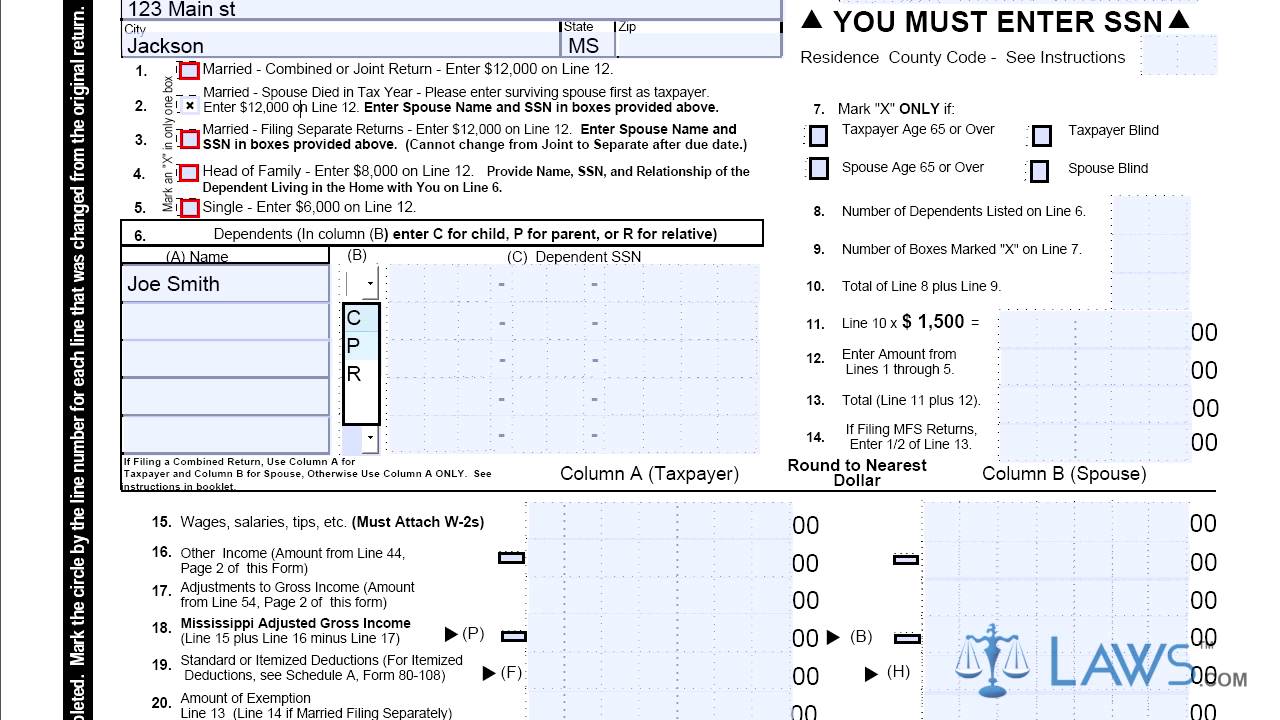

Income and Withholding Tax Schedule 80107218pdf Form 80-107-21-8-1-000 Rev. 0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make. Form 80-105 is the general individual income tax form for Mississippi residents.

The current tax year is 2021 with tax. Mississippi state income tax Form 80-105 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Welcome to The Mississippi Department of Revenue.

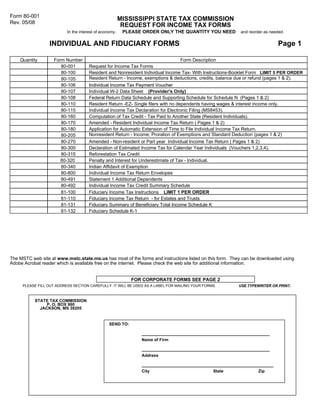

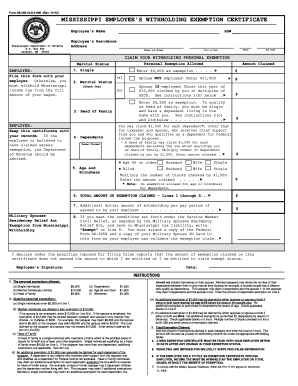

Form 80-100 - Individual Income Tax. Bond Forms Form 89-350 - Withholding Exemption Certificate Completed by employee. Printable Mississippi state tax forms for the 2021 tax.

For the forms belowPlease print complete sign if required and return the completed document in one of the following three ways listed belowUpload toDawg Documents - Securely upload. More about the Mississippi Form 80-107. More about the Mississippi Form 80-105.

Department of Revenue - State Tax Forms. A downloadable PDF list of all available Individual Income Tax Forms. Mississippi Department of Finance and Administration.

This form is for income earned in tax year. All other income tax returns. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Any income over 10000 would be taxes at the. SBAgovs Business Licenses and Permits Search Tool. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due. 18 Credit for tax paid to another state from Form 80-160 line 14. Payment Voucher and Estimated Tax Voucher 80106218pdf Form 80-106-21-8-1-000 Rev.

Form 89-140 - Annual W-2 and 1099 Information Return Fill In Version. 19 rows Mississippi has a state income tax that ranges between 3 and 5 which is. Mississippi Tax Brackets for Tax Year 2021.

We last updated Mississippi Form 80-107 in January 2022 from the Mississippi Department of Revenue. Attach other state return 19 Other credits from Form 80-401 line 1 21 Consumer use tax see instructions.

Form 89 350 Withholding Exemption Certificate Completed By Employee Retained By Employer

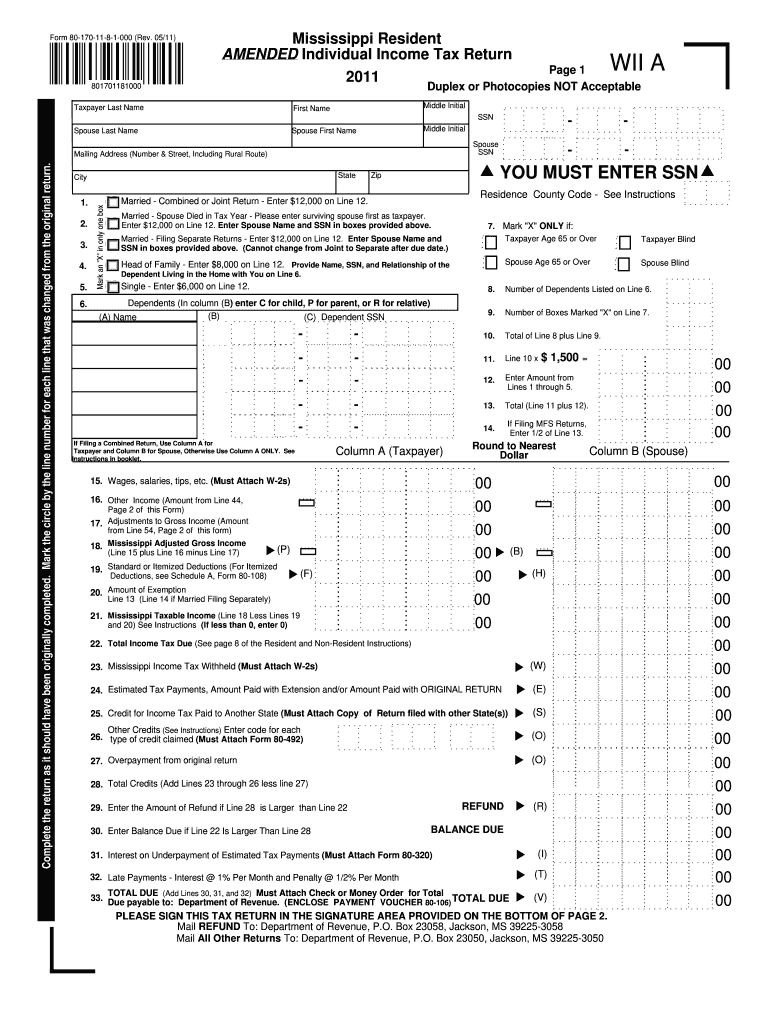

Form 80 170 Mississippi Resident Amended Individual Income Tax Return Youtube

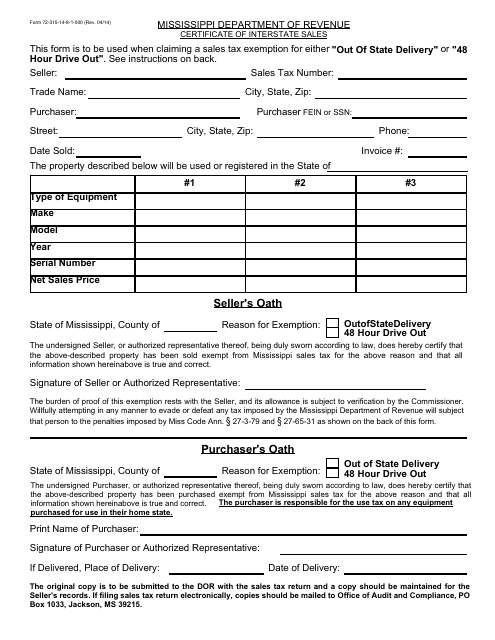

How To Register For A Sales Tax Permit In Mississippi Taxvalet

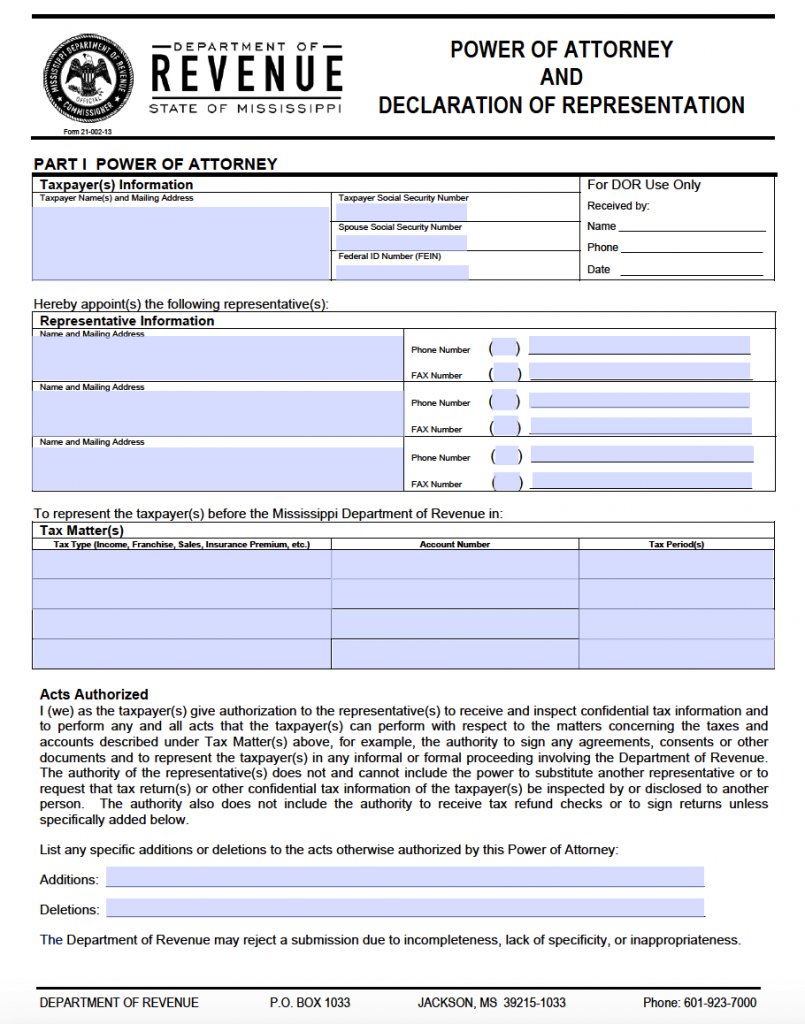

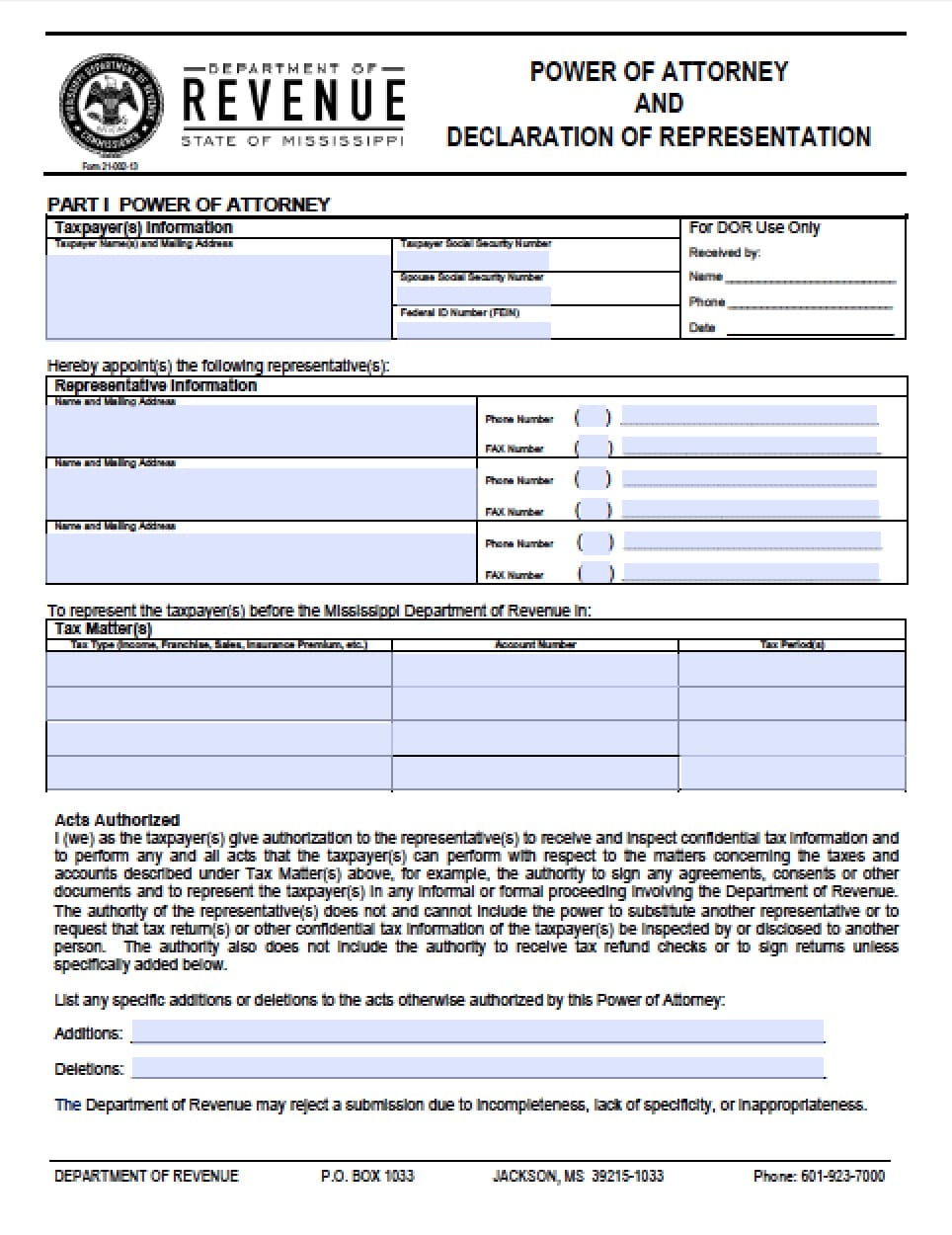

Free Mississippi Tax Power Of Attorney Form 21 002 Pdf Eforms

Instructions For Resident And Non Resident Individual Income Tax

Free Tax Power Of Attorney Mississippi Form Pdf

Mississippi State Tax Form Fill And Sign Printable Template Online Us Legal Forms

Mississippi Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi S Best Community Newspaper Mississippi S Best Community Newspaper

State Of Mississippi Sales Tax Non Resident Business Sales Tax Retail Sales Bond Ez Surety Bonds

State Individual Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Where To Mail Tax Return Irs Mailing Addresses For Each State

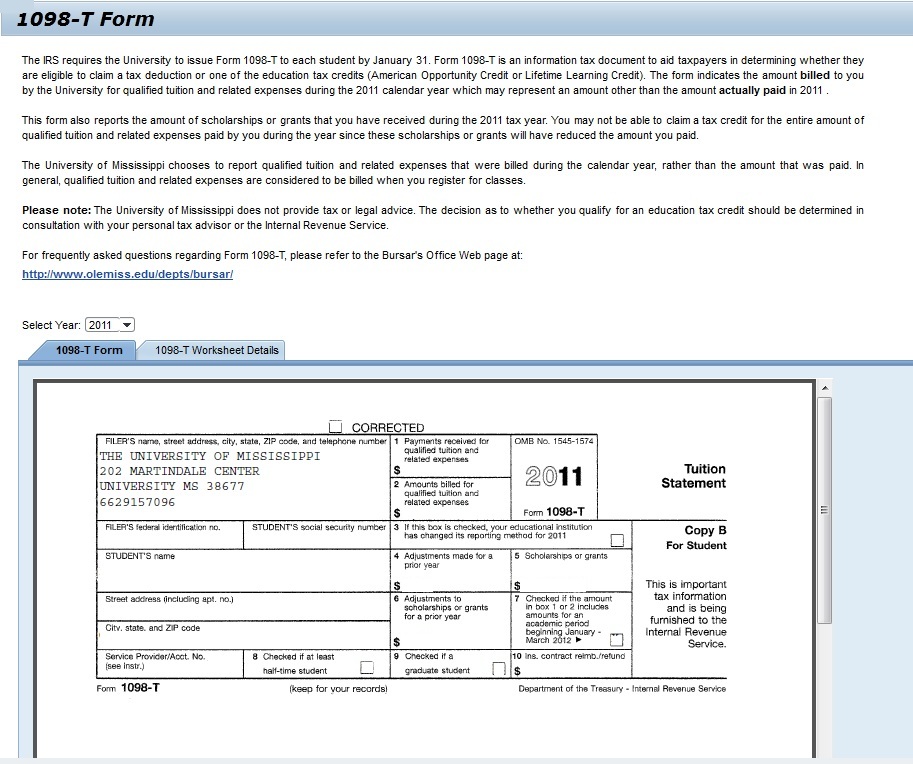

1098 T And 1042 S Tax Documents Technews Technews

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Bill Of Sale Form Mississippi Form 89 350 Templates Fillable Printable Samples For Pdf Word Pdffiller